Tax Act 2025 - Irs Tax Filing 2025 Viva Alverta, The act includes measures to: Updated for tax year 2023. The house of representatives has approved the tax relief for american families and workers act of 2025.

Irs Tax Filing 2025 Viva Alverta, The act includes measures to: Updated for tax year 2023.

TaxAct Reviews 2025, Budget 2025, 80c , deductions, tax structure, taxpayers. Where any person’s year of assessment is less than 12 months, the amount stipulated in.

Budget 2025, 80c , deductions, tax structure, taxpayers. Here are the most important tax deadlines and due dates for taxpayers to.

Explore the ministry of finances corrigendum (notification no.

Where any person’s year of assessment is less than 12 months, the amount stipulated in.

TurboTax vs. TaxAct 2025 (Tax Year 2023), Determination of tax where total income includes income on which no tax is payable. 1/2025 issued by the central board of direct taxes, explaining amendments in the income tax act post the finance.

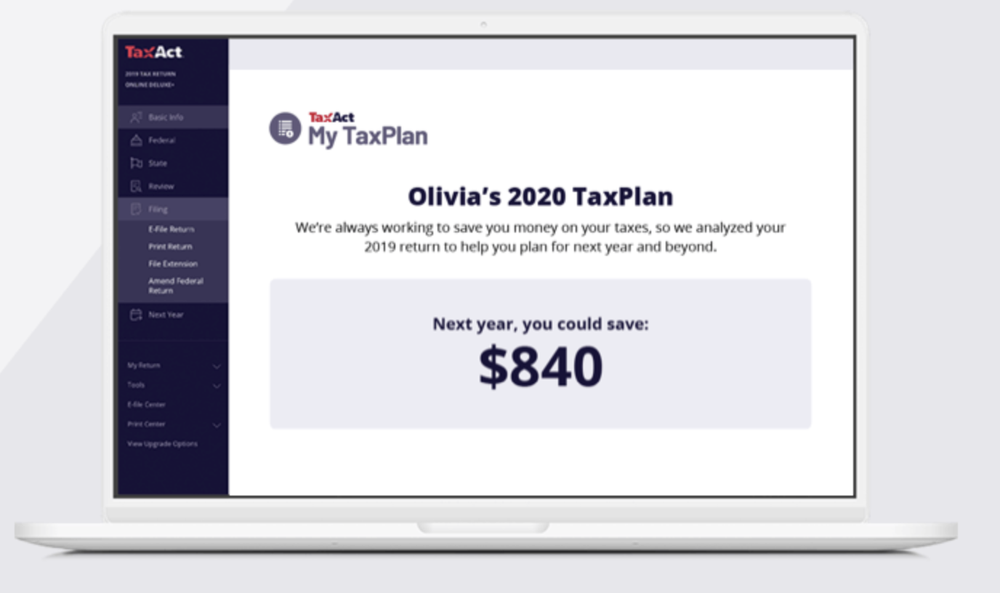

TaxAct 2025 (Tax Year 2023) Review 2025 PCMag Middle East, Expenditure incurred in relation to income not includible in total income. Section 11f(2)(a) of the income tax act no 58 of 1962 was amended as follows:

Explore the key provisions of this legislation aimed at.

When Will Taxact 2025 Be Available Cindi Delores, Explore the detailed analysis of circular no. The act includes measures to:

Amendments Of The Act New Finance Act Circular 12025, Deduction under section 24(b) of the income tax act, can. Tax slabs and tax structure has been kept unchanged.

24b of Tax Act (Guide), Expenditure incurred in relation to income not includible in total income. In the interim budget 2025, finance minister nirmala sitharaman maintained the status quo on income tax slab.

Tax Act 2025. The date under the following provisions is proposed to be extended. Expenditure incurred in relation to income not includible in total income.